One Property is Enough for Anyone. There I’ve said it…

And I’ll say it again louder for the people at the back. One property is enough for anyone and I don’t care who comes for me… But hear me out…

Home ownership is important because:

Everyone needs a home. It’s a fundamental need and we all deserve to have the security of a home. One that we know is actually ours and doesn’t make a profit for someone else.

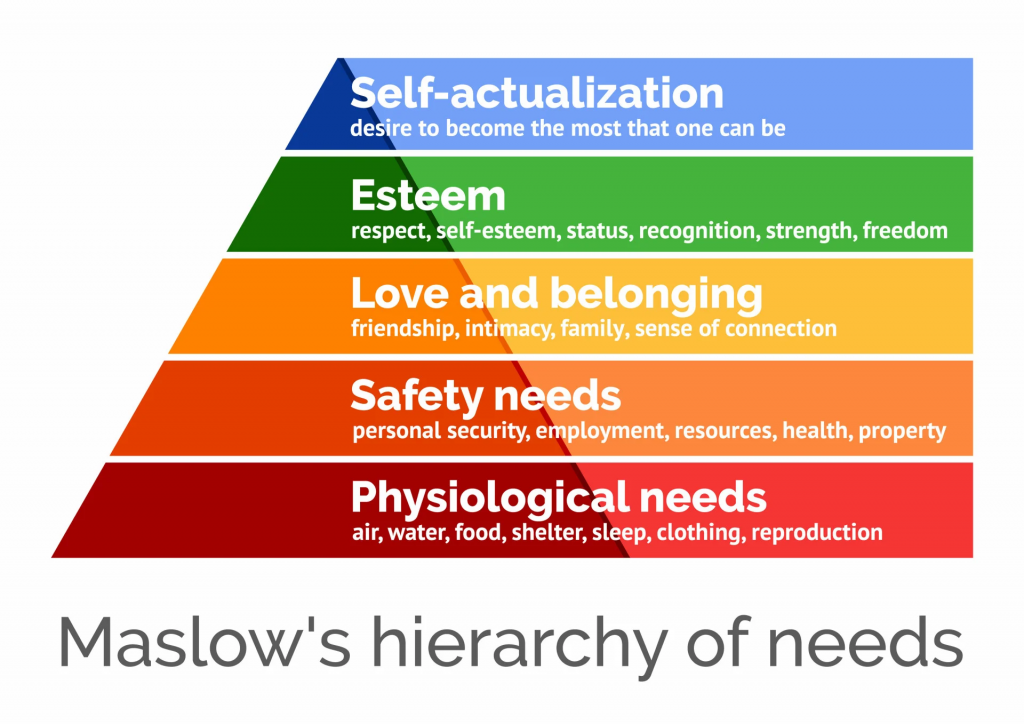

Maslow’s Hierarchy of Need

Maslow explains it perfectly

The stuff at the bottom has to be met before we can progress through each of the stages. From the diagram, we see it straightaway an essential physiological need: Shelter – As we know it a home

That essential need of a home, evolves as it passes through the stages. Personal security, safety, a sense of connection, status, freedom, all of these are linked to our homes.

How do we ensure that we can have these needs met? Again simple, we have to own our own homes.

Background

To understand why I see home ownership the way I do, you’re going to need some context, so let’s rewind…

My grandparents had done pretty well for themselves. They worked hard, both of them, both worked, my grandmother in jobs that fitted around raising 6 children. They bought a home, putting down roots, before starting to enjoy retirement.

But, I grew up, mostly in poverty. It was a complicated home life, chaotic, troubled, some basic needs were met, but not consistently and generally it just wasn’t great… (That’s putting it mildly). I had an extended family that did their best to plug the gaps, which wasn’t without it’s own issues. But anyone who has been in that situation will know, it’s not the same.

I went off the rails as a teenager. Pregnant at 18, homeless and now determined to have a very different life. (Spoiler: I fucking do have a very different life!)

Experience

My grandparents were Irish immigrants, who never seemed to consider England their permanent home. As far as they were concerned, it was temporary until they could go home. I was raised Irish in England.

I doubt you know much about Irish history and why would you?

But basically the nuts and bolts of it are: Landowners and Landlords = Bad. My grandparents came from a line of tenant farmers. Their families eventually came to own the land they farmed through changes in legislation and Irish independence. But it was a struggle.

So when they came to England, owning a home and having that security was important. It was also important to them that their children owned their own homes too. I think there was bit of we’ll show you, us Irish can own English land!

Irish history is really good at showing us the perils of being a tenant…

and a source of income for someone else. So you know, owning your own home is important. It gives you a security you just don’t have when you rent, unless you live in social housing. If someone else owns your home then they have power and control over your life.

Now before everyone comes for me; I know there are some decent landlords. I’ve had a couple, but my life and work experience has shown me more wrong uns than good uns. That’s because these properties aren’t homes to these landlords, they’re assets, and just a way to make money without working for it.

In my experience the good landlords are the ‘accidental’ landlords the ones who inherit a property and rent it out while they decide what to do. But we don’t see good landlords like there were in previous generations: Think Cadbury, Sir Titus Salt, Listers… Big employers who built homes for their workers. The landlords we see now are from the Victorian era, the English landowner in Ireland kind and it blows my mind.

I’ve been homeless (not street homeless), lived in temporary accommodation, social housing, privately rented and now I own my own home. The whole gambit, some quite frankly absolute shit holes – but you make the best of it, to create a home

My life now is the one I dreamed of and I’ve worked bloody hard for it, but the people trapped, renting are working bloody hard too except it’s not going into their pocket or future, it’s going into the landlord’s pocket.

Why one property is enough: The Scourge of the Landlord – Homes not Profit

Landlords buy the cheapest properties they can to rent out. Usually these are ex local authority properties that have been bought through right to buy and the original owners have moved on.

You can have 2 tenants living side by side, lets say in a 3 bed house. One is renting privately, one from the council, yet one is paying £1200 a month rent and the other is paying £450.

That landlord’s mortgage affordability isn’t calculated on their income and assets, it’s calculated on the rental income from the property, which depending on the tax status of the landlord means that the rental income has to be up to 165% of the mortgage payment.

So what does that look like?

Here’s what it looks like in Stroud (Where I am based):

- Lower cost 3 bed house: £280000

- 25% deposit (This is the minimum required for a buy to let mortgage): £70000

- Mortgage: £210000

Depending on the mortgage product chosen: 2 year, 5 year fix the monthly rental income required to secure a mortgage would range between £1266 and £1911 – this would be on an interest only basis.

An equivalent residential mortgage the monthly cost with a 25% deposit would be between £952 and £991 on a capital repayment basis.

If we look at the costs for the same property with a 5 % deposit, again, on a residential mortgage and on a repayment basis; the monthly costs would be between £1323 and £1383

And people wonder why rental costs have increased by 90% in the last 10 years 🤯 and why people are struggling to buy their own homes?!

The gap is immense how can this be ok?

And I haven’t even got started on the next problem it causes:

Homelessness

The maths aint mathing…

Let’s say your rent is £1200, you’re a single parent with one child, work as a teacher, childcare costs of £450, no debt (highly unlikely but lets run with it) you’ve been qualified a few years so you’re earning £35674 (This is less than the median average in the UK) Take home pay on that (after deductions, pension and student loan) would be: £2157

Local housing allowance says that actually rent for a 3 bed house is £725 they won’t consider the full amount of £1200

£2157 – £1200 – £450= £507 to pay for everything else, so this teacher has to claim universal credit. A teacher on benefits! Bloody scroungers!

This teacher would be eligible for £819.54 a month, so now they have £1326.54 for all of their essential living costs… It’s not a huge amount and there’s definitely no room for saving a deposit.

Teachers earn more than minimum wage, this teacher’s salary will increase so their situation will improve, but imagine if you’re stuck in a minimum wage job?

Whatever their job is, if they lose it, their household income drops to £1788.90, leaving them £588.90 to live on after paying their rent = Homelessness

It can and does happen to people from all walks of life, all it takes is one big life event and then…

How do we fix it?

The government needs to intervene, at the moment the banks control the private rental market through the way they calculate affordability for buy to let mortgages but also the way they assess residential mortgage applications.

There needs to be greater regulation of the private rental market, there needs to be a review of local housing allowances so that they are in line with actual market rents now in 2025

We need more affordable housing

There needs to be greater support for home ownership, lenders don’t have the appetite to support people out of rented and into home ownership; smaller deposits, looking at rent payment history, government schemes… There are options…

Ultimately, it’s simple…

Home ownership, like everything else in life could all be very simple, but unfortunately, a lot of people benefit from overcomplicating every aspect of human life and so here we are.

My philosophy? Don’t be a Dick. You’re free to do exactly as you please, as long as your actions don’t cause harm to other people and if you’re going to be decent, then your actions should actively improve the lives of other people. There’s enough for everyone – we don’t have to be greedy.

One home is enough for anyone – your life might mean that you have to live in different places, so maybe I can see the need for a second home, in those circumstances. But I don’t see the need for owning property as an asset, if it prevents someone else from owning their own home; because in my opinion that causes harm, real harm.

Knowledge is Power – Why one property is enough

I get it, we’re all in our own little bubbles trying to get on in life and it’s easy not to see what’s happening to others around us, because we’re concentrating on just what’s directly in front of us and we don’t have the time or energy to get involved. But if you do want to know more, the links below are a good place to start.

Useful Links

Thanks xx