Family Income Benefit

What it is. Why you need it and if you have to have it!

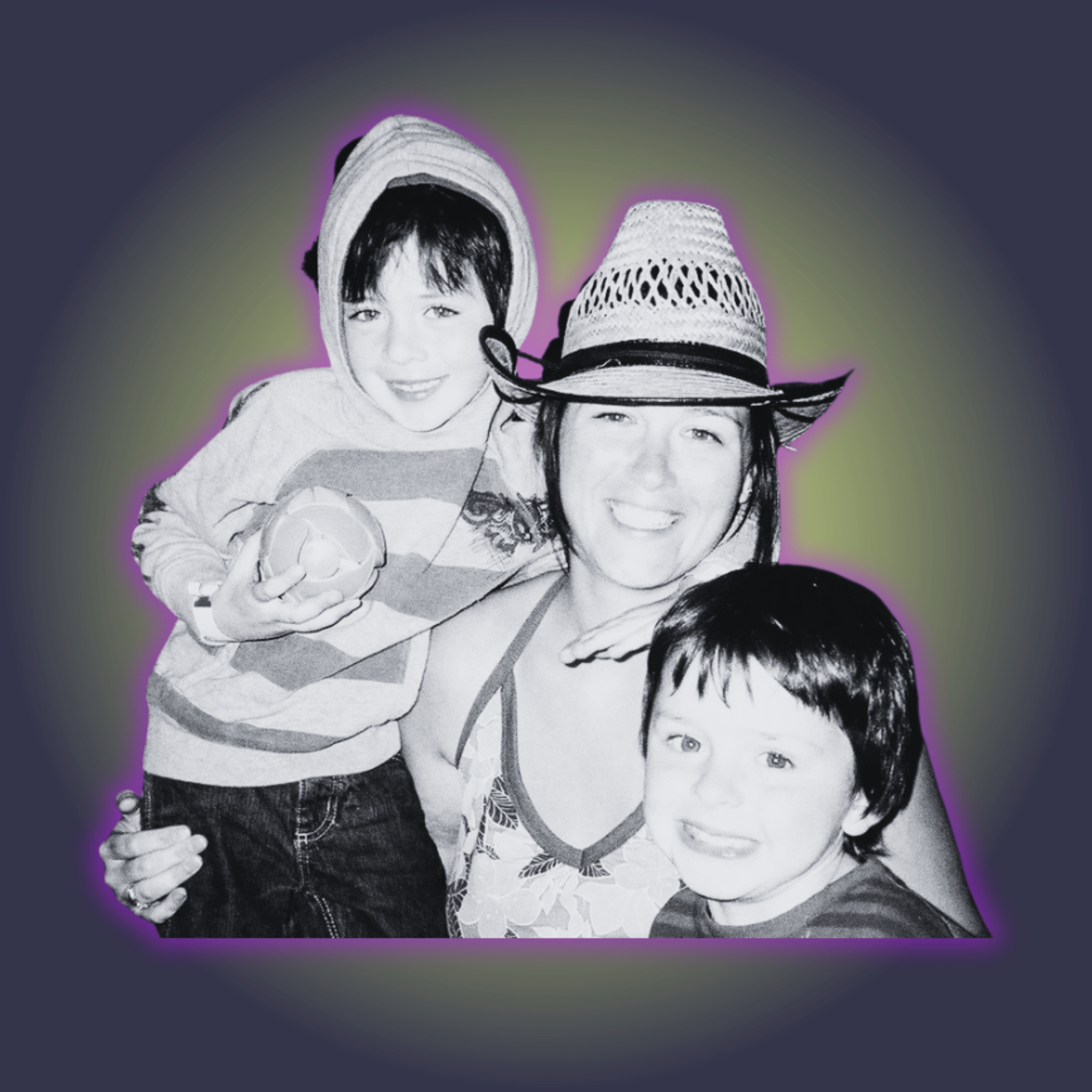

If you’ve read my about me page you’ll know that I have adult children. They are in their early 20’s and pretty much independent now, so if I shuffle off my mortal coil I don’t have to worry about providing for them financially as they have their own sources of income.

But if you have children who are still dependent, then it’s super important to think about how your family will protected in the event that you or their other parent were to die. We often think about who we’d like to look after them, but not how everything they need would be paid for

When considering all of your protection options you may (or may not!) have heard of Family Income Benefit Insurance. This is an option that will pay an income in the event of your death.

What is Family Income Benefit Insurance?

Family Income Benefit Insurance is a fixed term insurance policy that pays out if you die within the term of the policy.

The policy pays out a monthly tax-free sum that is designed to replace your income if you die and it can be used to cover the cost of mortgage, bills, childcare etc. Basically all the costs of day to day family life.

The policy only pays out if you die within the term and then only pays until the end of the fixed term.

For example if you have a twenty year term and you die in year two, the policy will pay a monthly sum for the remaining eighteen years, but if you die fifteen years into the term, it will only pay the monthly sum for the remaining five years.

How much cover?

You will need to think about how much money your family will need if you die.

Ideally you want to cover as much of your current income as possible to ensure that the mortgage, bills, childcare, car finance etc. would all be covered.

However, be aware that this (like the term) will directly affect the cost of the policy.

How long for?

Most people fix the term to coincide with their children becoming adults and no longer being financially dependent.

It is usual to fix the term until your youngest child turns twenty one but this can be amended depending on what best suits your family. (Remember: the longer the term, the more expensive the policy will be.)

Joint or Sole Policy?

Family Income Benefit policies can be taken out for a single person, or as a joint insurance policy. Where a single life insurance policy is taken out you should consider placing the policy into trust for the person you intend to receive the money. This person is known as the beneficiary. There is more information about trusts here.

🤔 Do I have to have it?

No. The only insurance that is a condition of your mortgage contract is Buildings insurance. BUT if you were to die and leave dependent children, it would replace your income and ensure that there was enough money available to meet the costs of raising them, so their quality of life would not suffer, it is advisable to have cover in place.

GET IN TOUCH